Economic Projections

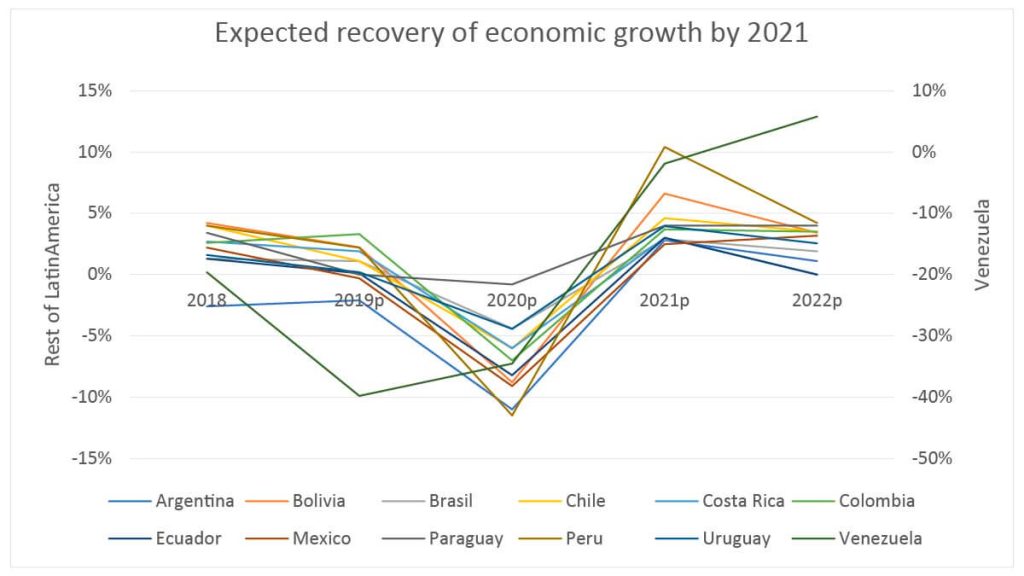

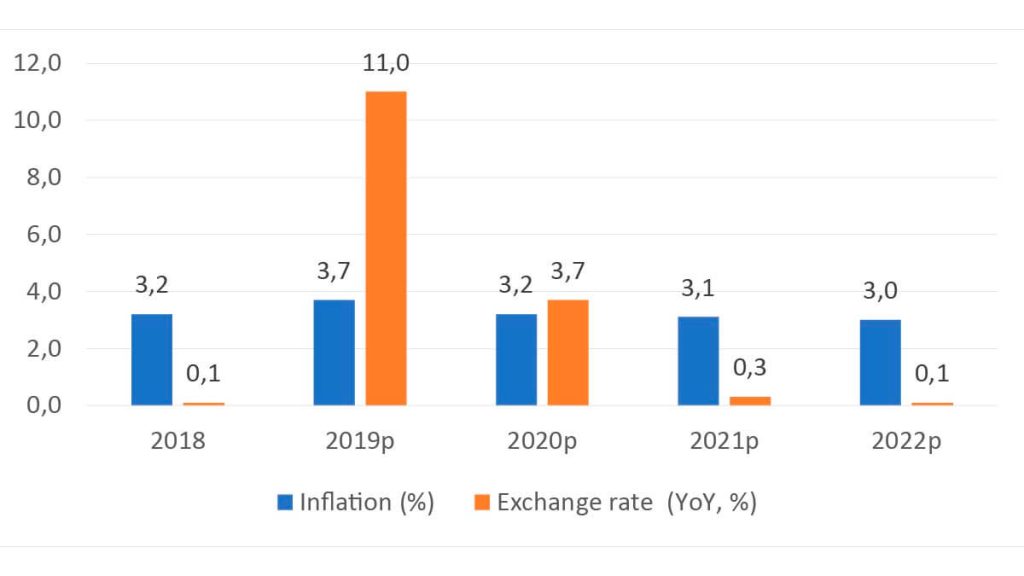

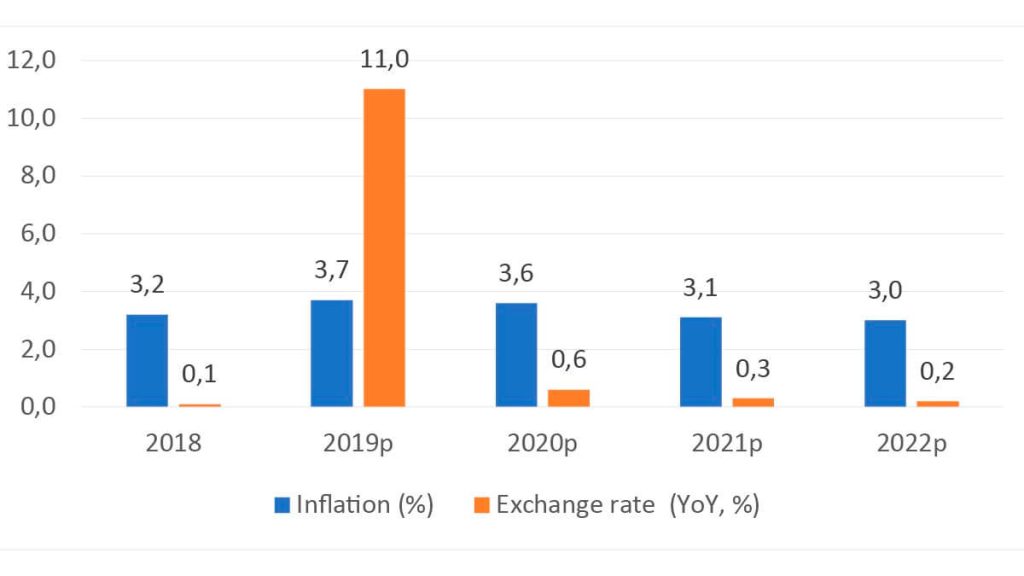

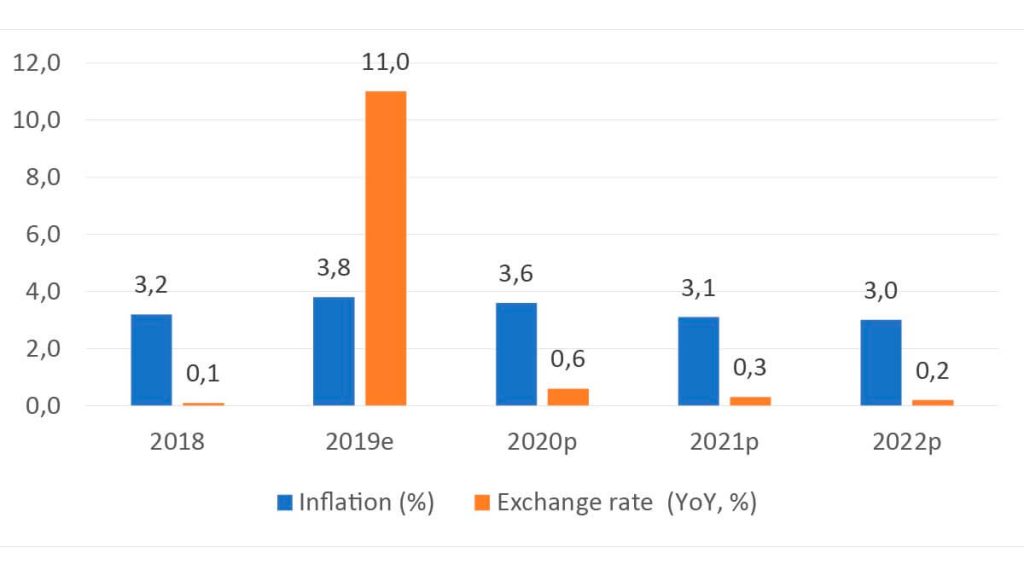

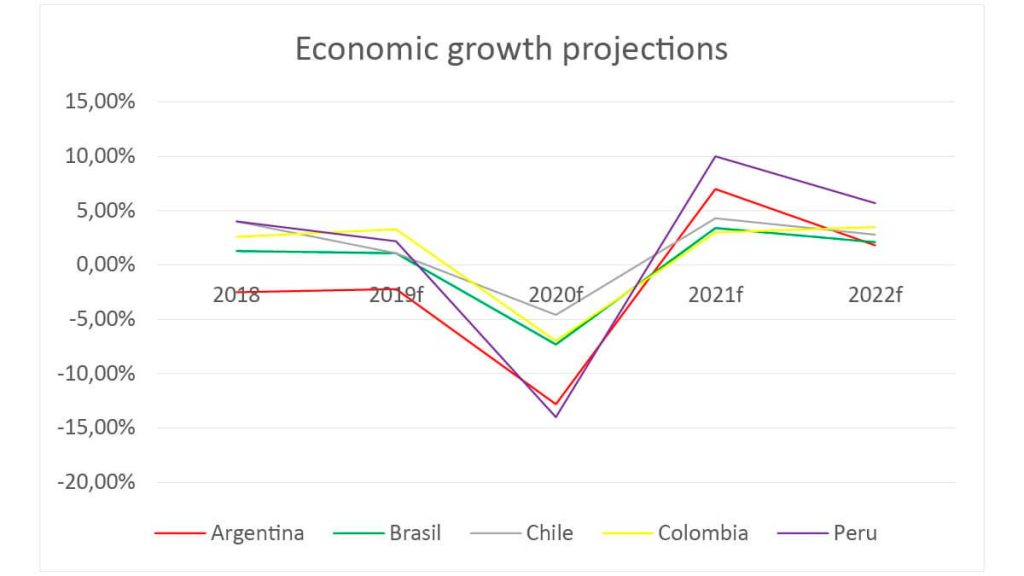

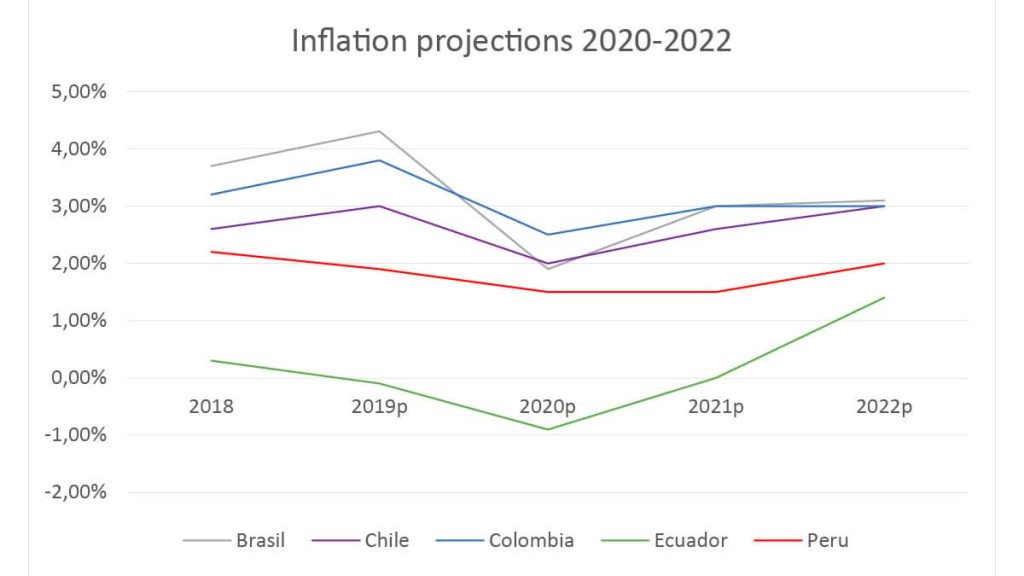

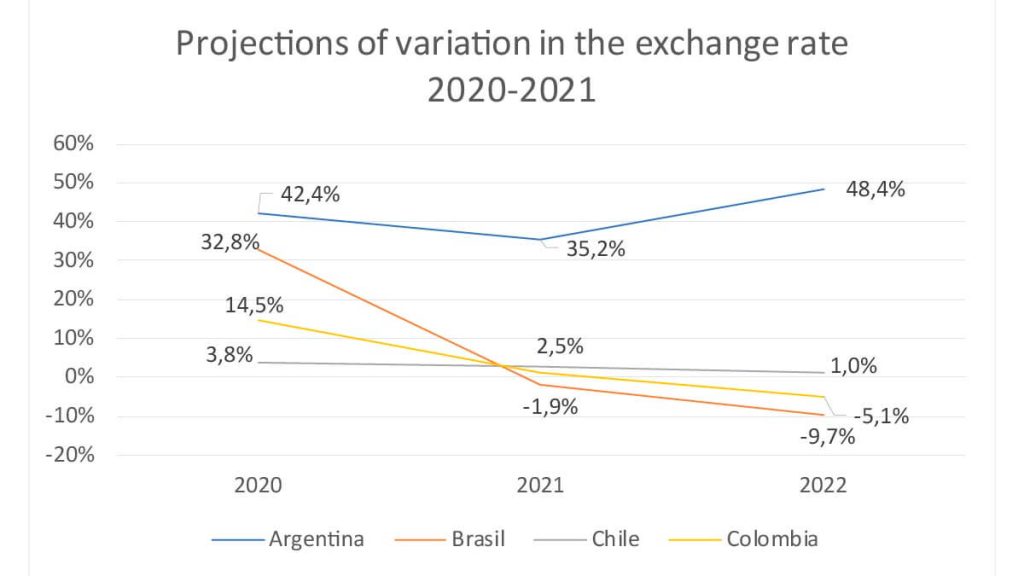

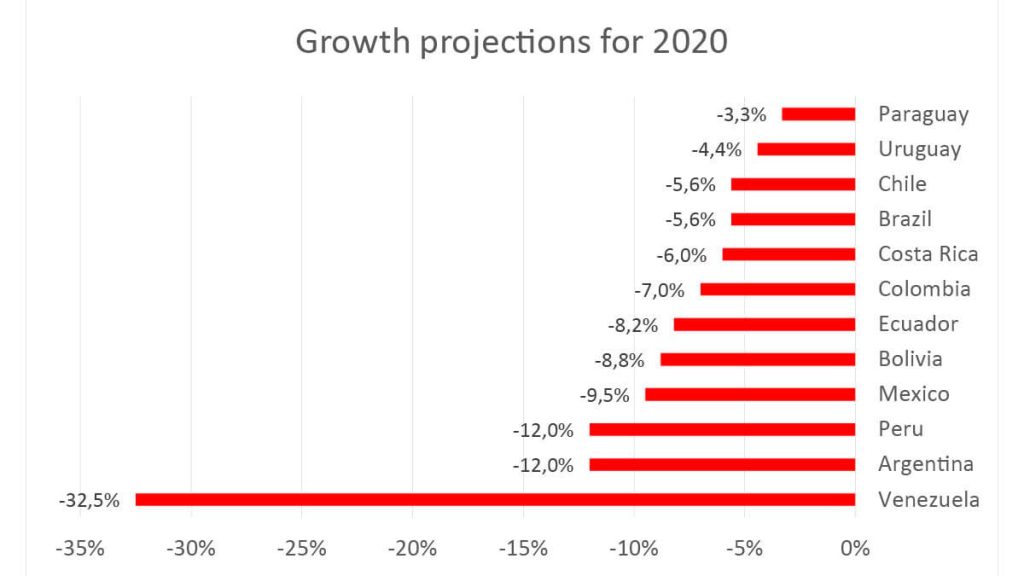

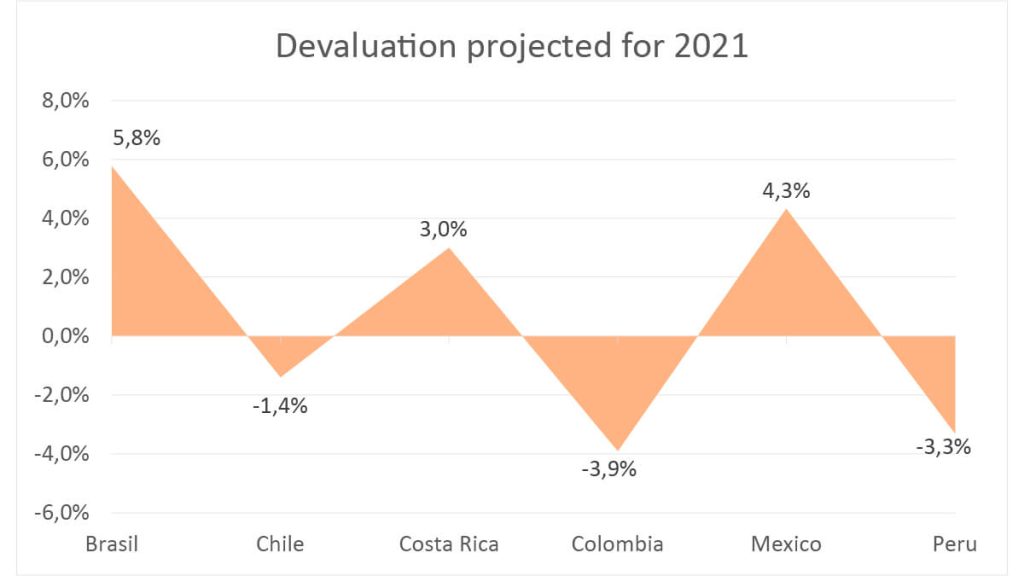

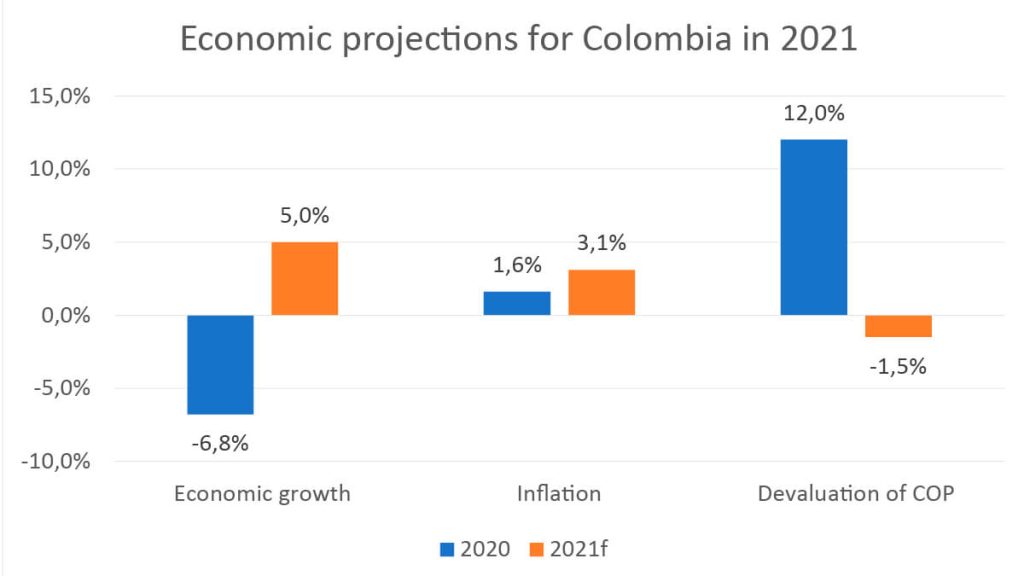

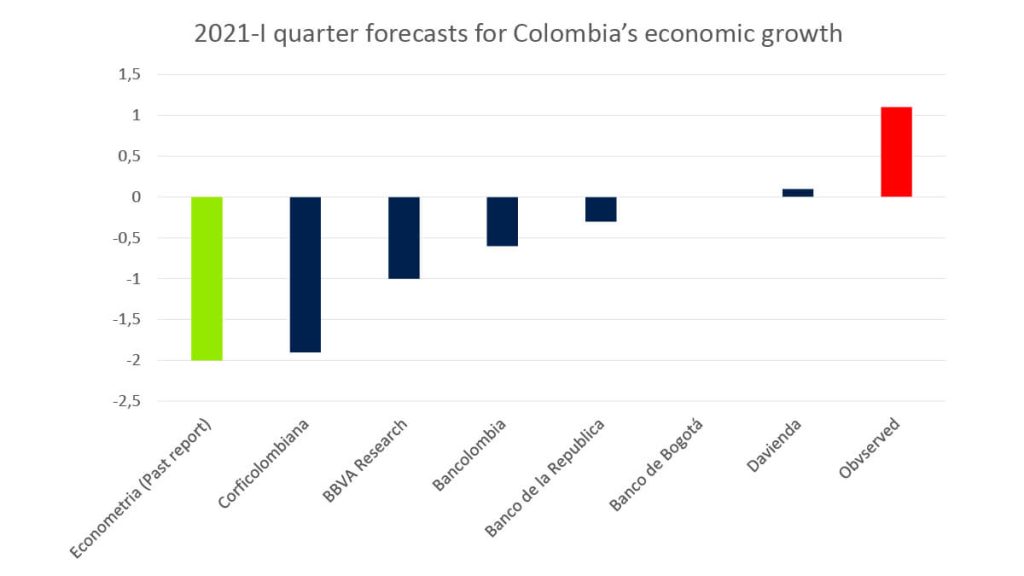

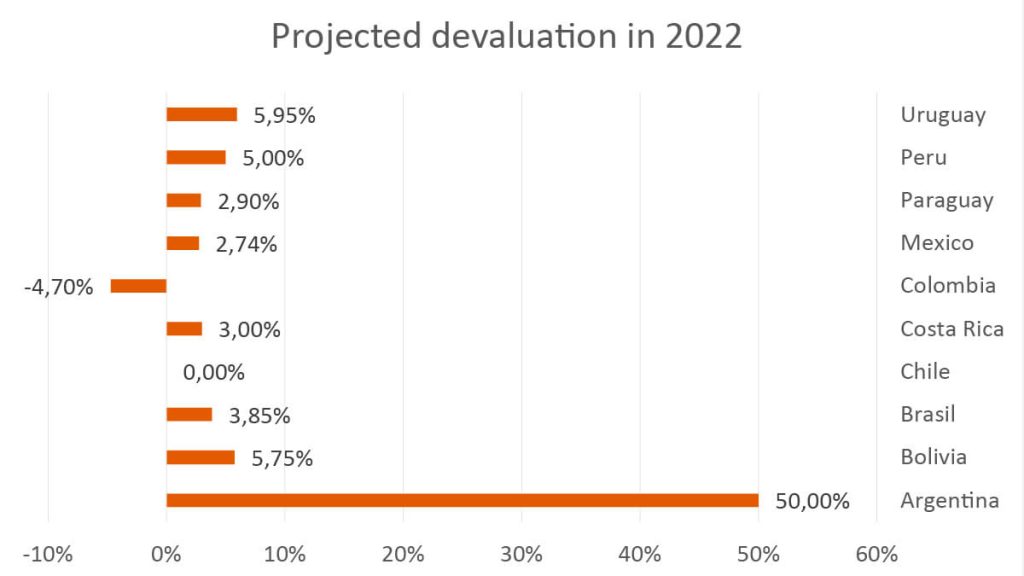

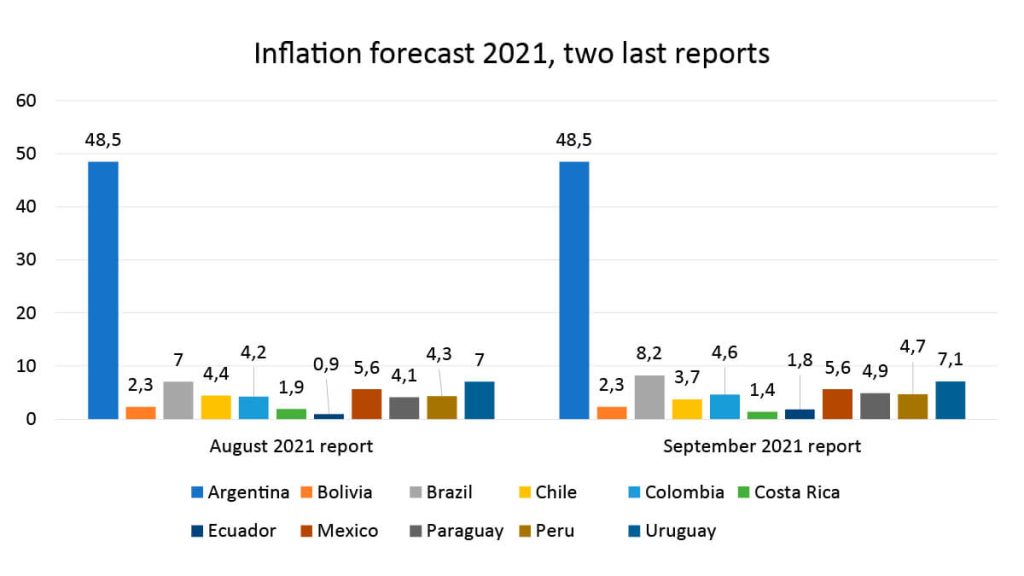

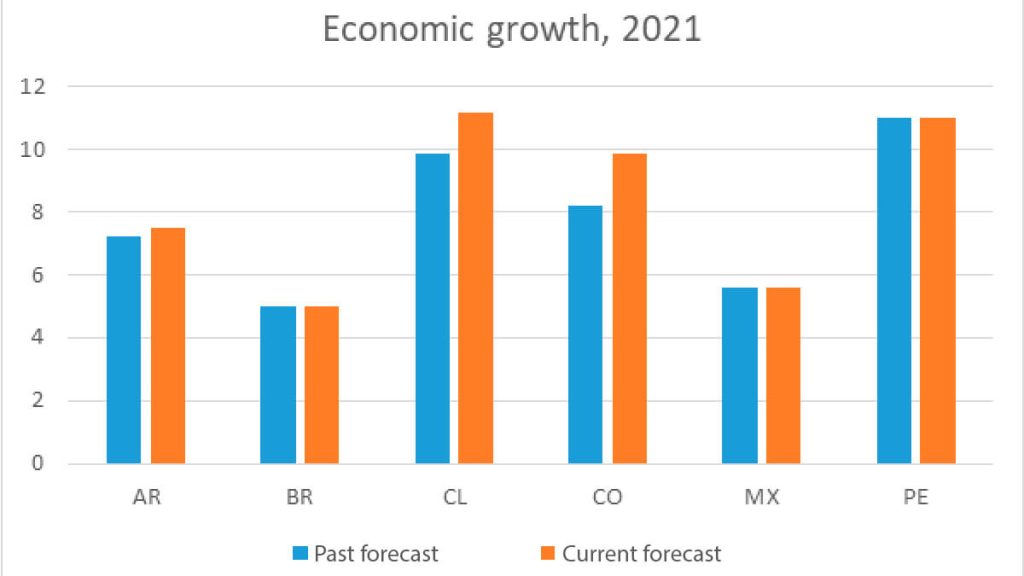

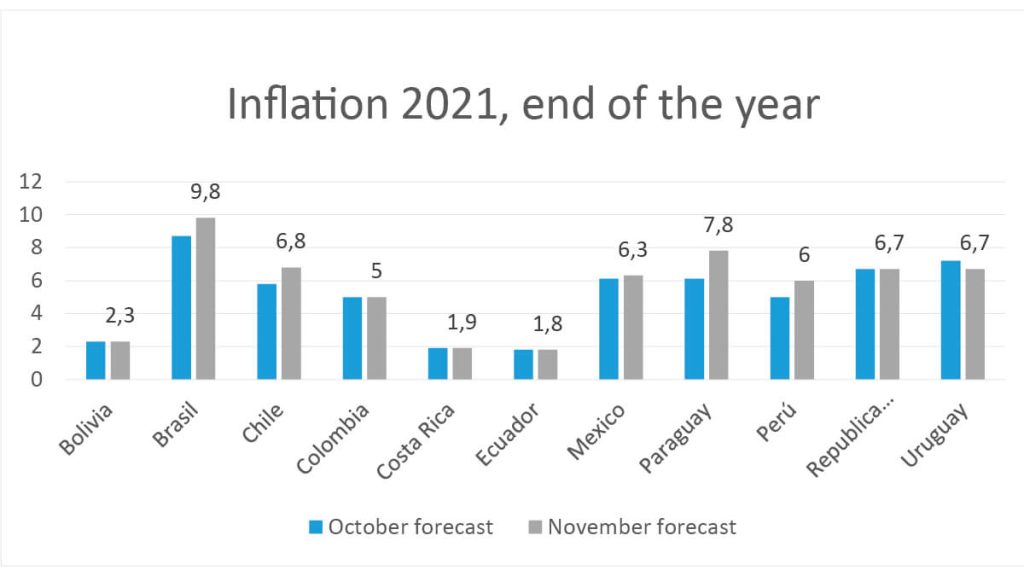

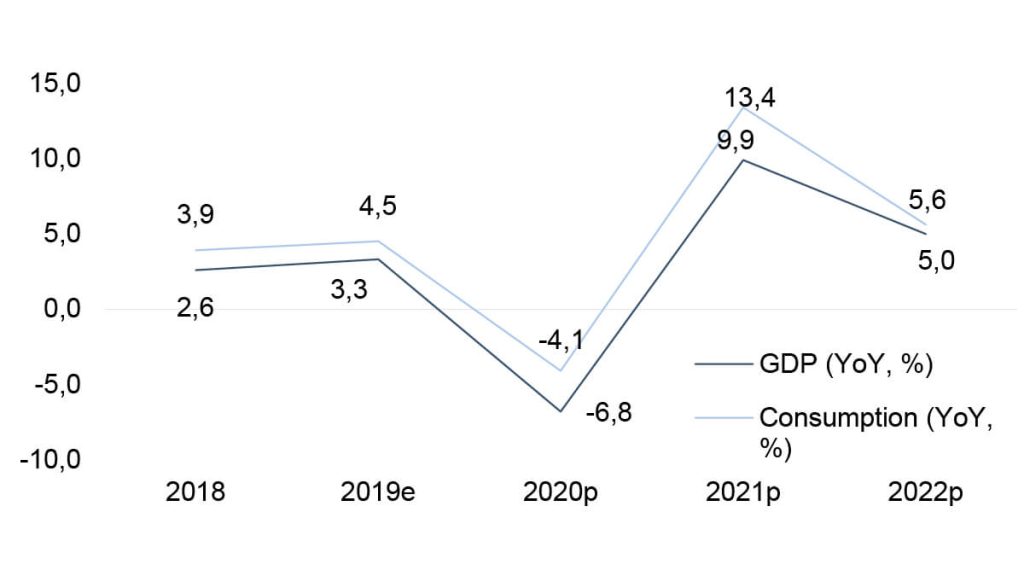

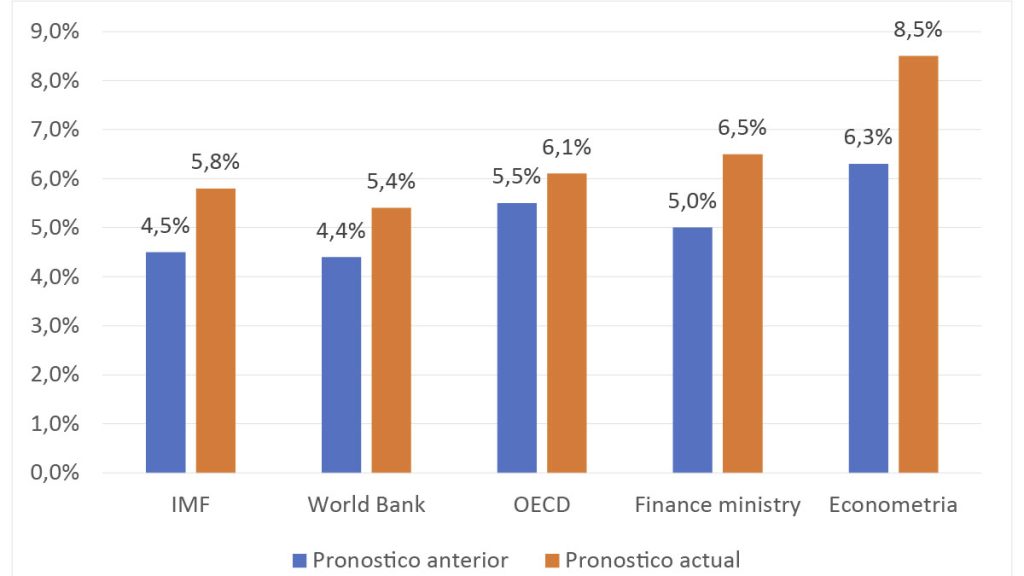

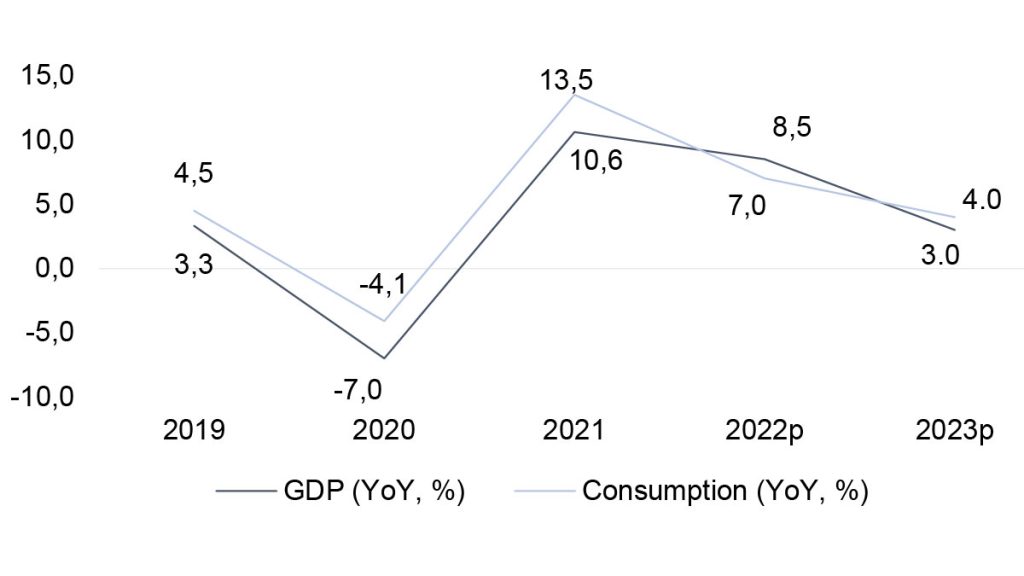

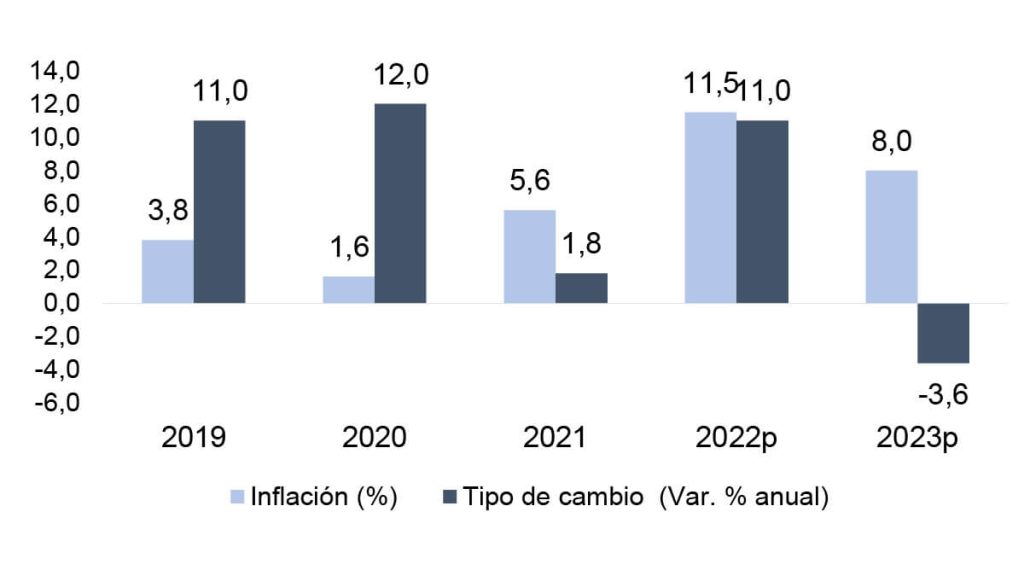

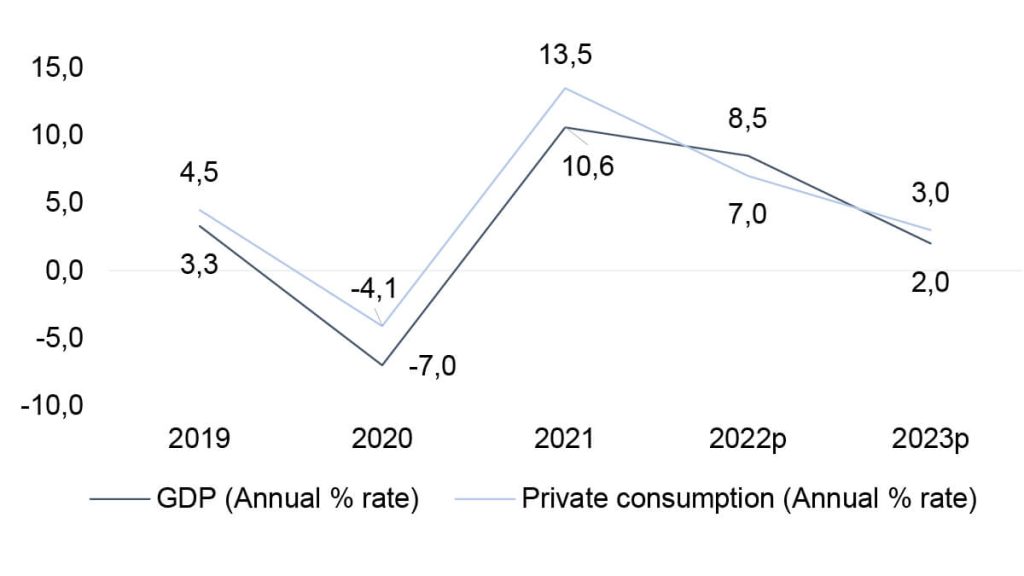

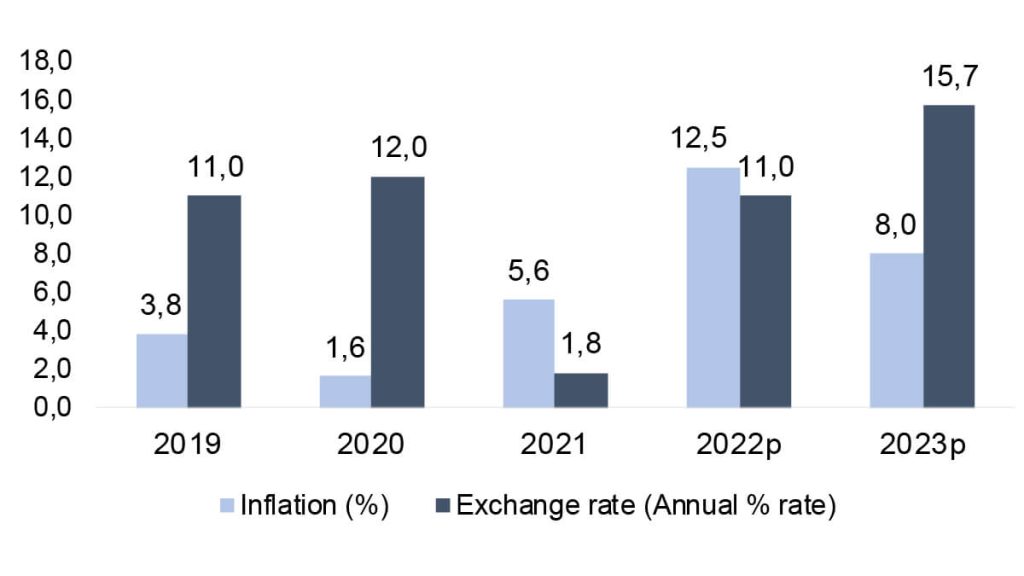

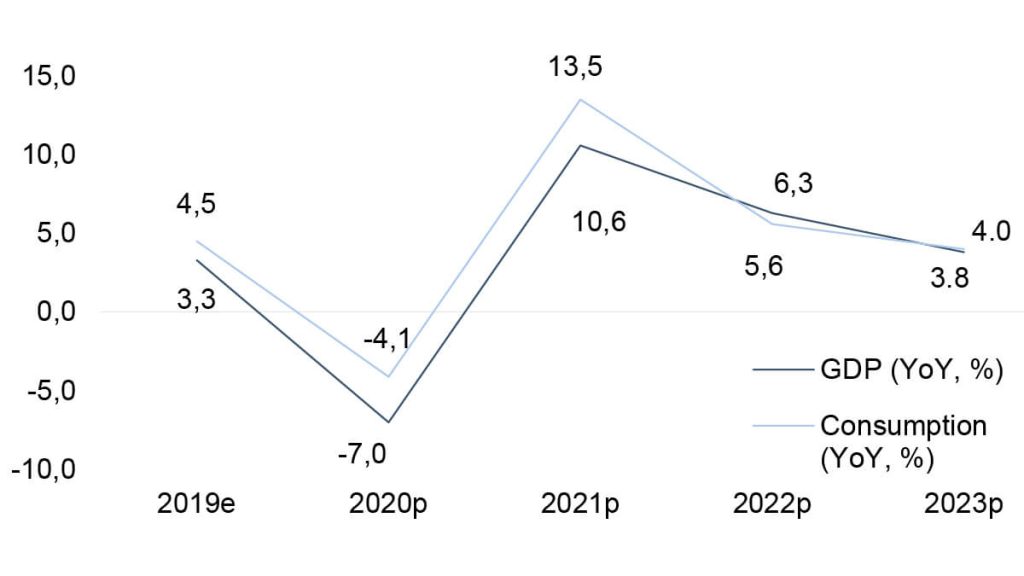

One of the services that we offer at Econometría Consultants is projections on principle macroeconomic variables and an analysis of the economic situation in Colombia. This service is offered in conjunction with organizations in twelve Latin American countries which form part of the Latin American Alliance of Economic Consultancies – LAECO.

LAECO presents a monthly summary of the economic and political situation in each country, as well as providing a service of sectoral studies on a local and regional level. The following are a selection of economic analyses carried out by the organization.

Best analysis | Best decisions

Sections

More links

Our social networks

© 2022 Econometría Consultores SAS | All rights reserved | Sitemap